Understanding the Fuel Tax Credit Internal Revenue Form

Understanding the fuel tax credit

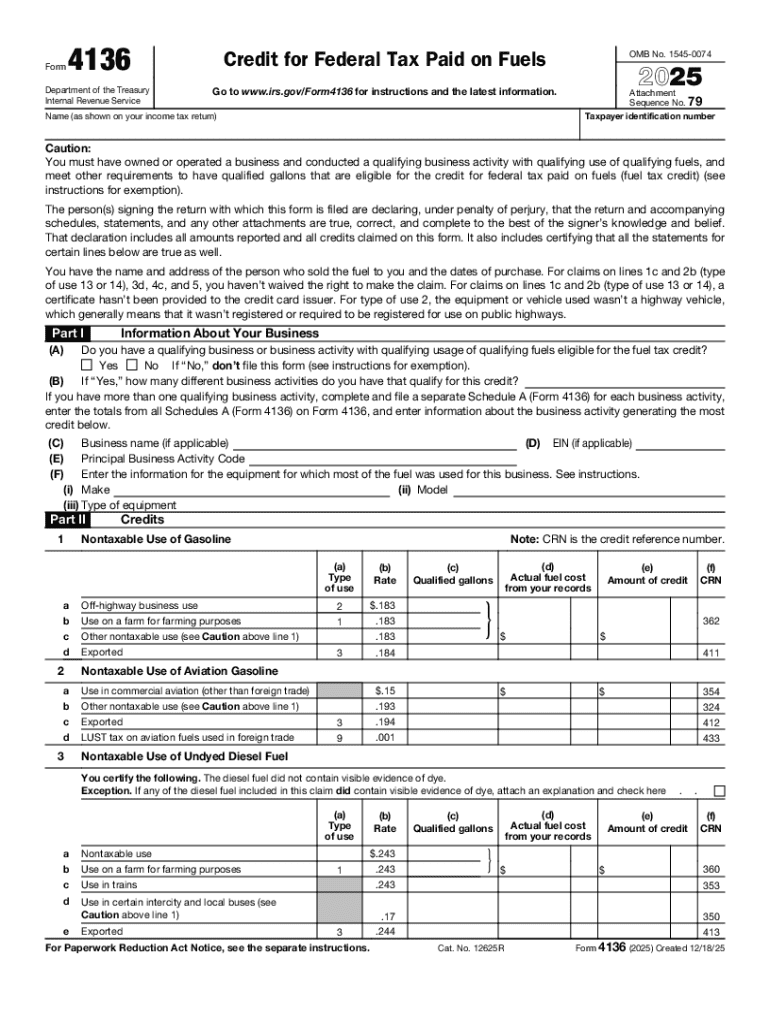

The fuel tax credit is a federal tax benefit designed to reimburse taxpayers for certain taxes they pay on fuels used for various purposes. This credit is particularly beneficial for individuals and businesses that rely on fuel for transportation, farming, and manufacturing. As fuel prices fluctuate, the importance of securing tax credits cannot be overstated. By filing for the fuel tax credit, taxpayers can receive significant savings, making it a crucial aspect of tax planning.

Reduces overall tax liability, contributing to better cash flow.

Encourages the use of alternative fuels, promoting environmental sustainability.

Supports industries reliant on fuel, such as agriculture and transportation.

Eligibility criteria for claiming the fuel tax credit

To qualify for the fuel tax credit, individuals and businesses must meet specific eligibility criteria. Generally, the credit is available to those who can prove that they have paid fuel taxes for eligible use. This includes individuals using fuels in their homes and businesses using fuel for commercial activities. The Internal Revenue Service (IRS) has outlined specific requirements regarding the types of fuel covered and how they can be utilized.

Different types of fuels may have their own regulations. For instance, gasoline and diesel used for farming purposes can qualify for additional credits. Farmers, for example, can benefit from credits applicable to off-road vehicles and equipment used in agricultural production. Businesses involved in transportation can also claim credits for fuels used in qualifying vehicles. Understanding these categories is crucial for maximizing potential benefits.

Individuals using fuel for personal use may qualify in certain cases.

Farmers can claim additional benefits based on agricultural usage.

Businesses must ensure they meet IRS definitions for qualifying vehicles.

Navigating the fuel tax credit internal revenue form

Filing for the fuel tax credit involves utilizing various forms, primarily IRS Form 8849. This form is essential for claiming any refund of excess taxes that have been paid on fuels. In addition, many taxpayers may need to complete Schedule 1 for specific additional deductions. The forms can be conveniently accessed online via pdfFiller, allowing for seamless document management and creation.

Using pdfFiller, you can download the necessary forms in a user-friendly format, which is especially beneficial for those who regularly file taxes. The platform not only allows you to access the forms but helps in filling, editing, and managing them efficiently, which is vital during tax season.

Step-by-step instructions to fill out the fuel tax credit form

Completing the fuel tax credit form requires attention to detail. Below is a breakdown of the sections you will need to complete:

Provide essential details like your name, address, and Employer Identification Number (EIN) if applicable.

Specify the types of fuel consumed, such as gasoline or diesel, and report the quantities used during the tax year.

Understand how to compute the credit, applying the relevant formulas for your fuel consumption.

Gather supporting documentation, including invoices and receipts, ensuring they align with your claims on the form.

Accurate completion of these sections is crucial for a successful filing.

Interactive tools for document management

pdfFiller enhances your experience with several interactive tools designed for efficient document management. You can create, fill, edit, and send your Fuel Tax Credit form directly from the platform, ensuring all information is accurate and up to date.

The eSignature feature in pdfFiller allows you to sign your forms seamlessly. This eliminates the need for printing and scanning, making the submission process quicker. Additionally, collaboration tools are available for teams, enabling multiple individuals to work on the document simultaneously, ensuring all inputs are considered before submission.

Common errors to avoid when filing the fuel tax credit

Many taxpayers face claim rejections due to common errors made during the filing process. One frequent mistake is incorrect information input, such as misspelling names or providing incorrect EIN numbers. These inaccuracies can lead to significant delays and complications in processing claims.

Other common pitfalls include failing to provide complete documentation or forgetting to include essential forms like Schedule 1. Always double-check everything before submission. To prevent errors, utilizing tools like pdfFiller can help you maintain document integrity, ensuring all fields are filled out correctly and that your submission meets IRS requirements.

What happens after submission?

After you submit your fuel tax credit application, the IRS will begin its review process. Typically, it can take several weeks to a few months for the IRS to process your claims. During this time, they may reach out for clarification or additional information, so it's essential to stay responsive.

Understanding the timeframe for receiving any refunds or credits will help you manage your finances better. If your claim is approved, you can expect a credit or refund that will reduce or offset your tax liability.

Resolving claim issues: What if your application is denied?

In the unfortunate event that your fuel tax credit application is denied, you have the right to contest the decision. The first step involves reviewing the reasons for denial provided by the IRS. This will help you identify potential errors in your claim, such as documentation issues or eligibility misunderstandings.

Gather all necessary information for your appeal, including proof of fuel purchases and any previous documentation you submitted. Ensure to file your appeal timely, adhering to IRS regulations regarding deadlines for contesting a denial.

Maximizing your fuel tax credit opportunities

To maximize your fuel tax credit opportunities, consider additional deductions and credits available that align with your activities. For instance, some taxpayers may overlook credits associated with alternative fuel use or additional expenses related directly to fuel consumption.

For businesses, it's crucial to keep detailed records of all fuel purchases, as well as any associated expenses. By employing strategies such as hiring a tax professional or utilizing comprehensive tax software, you can identify additional claims you might qualify for, increasing your overall deductions.

Maintain records such as receipts and invoices for every fuel purchase.

Consult a tax professional to uncover additional credits available to you.

Leverage technology like pdfFiller to streamline your filing and documentation process.

Staying updated on fuel tax changes and regulations

Taxpayers must stay informed about changes in fuel tax regulations, as the IRS periodically revises guidelines and credit parameters. These updates can significantly impact the eligibility and calculated credits available in any given tax year.

pdfFiller ensures you have access to the latest forms and instructions right at your fingertips, aiding compliance with IRS guidelines. Regularly visiting the IRS website and utilizing professional tax services can ensure you remain compliant and up-to-date with any changes in the regulations.

User stories: Successful fuel tax credit claims with pdfFiller

Many users have shared their success stories regarding fuel tax credit claims facilitated by pdfFiller. For instance, a small business owner described how utilizing pdfFiller streamlined their filing process, saving them both time and money. After submitting their claim through pdfFiller’s user-friendly platform, they received their refund in an expedited manner.

Testimonials indicate that users appreciate the easy navigation and efficient collaboration features that pdfFiller provides, allowing tax teams to work together seamlessly while ensuring accuracy in their submissions. This platform not only simplifies the document preparation but also reinforces the confidence needed when filing important claims.